AI for Accountants: Workflow Automations vs Intelligent Agents

Accounting

10 Min Read

AI Is Moving Beyond Prompts and Workflows

AI in accounting is evolving. For the past year, most teams have experimented with AI in one of two ways:

Prompt-based tools like ChatGPT, where AI answers questions but doesn’t take action

Workflow automation, where predefined rules move data from one step to the next

Both approaches are useful but both stop short of solving the hardest problems in accounting.

As teams look to scale close, reconciliations, and workpapers, a new category is emerging: AI agents. These systems aren’t just generating outputs or executing scripts. They’re designed to reason, adapt, and act across real accounting workflows.

That shift raises important questions:

What do AI agents actually do?

How are they fundamentally different from workflows?

Where do they create value that automation cannot?

How can this be integrated into the day-to-day accounting work?

To answer those questions, it’s critical to separate AI workflows from AI agents because they solve very different problems.

What Are AI Workflows?

AI workflows are designed to execute predefined logic. They follow a fixed set of rules that determine what happens when a specific condition is met.

In accounting, workflow automation works best when data is clean, processes are linear, and outcomes are predictable.When those conditions are met, workflows can move data efficiently from one step to the next and reduce manual effort.

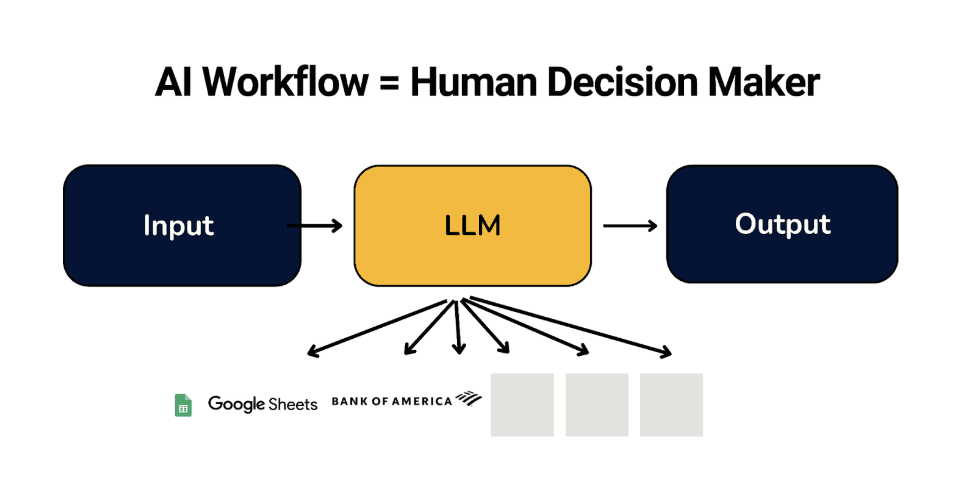

This is what the graphic illustrates. An input is passed to an AI model, which can help interpret the request or generate an output. The workflow may connect to multiple tools or systems, such as a payment system like Bank of America, but the decisions about what happens next are still made by a human.

The challenge is that accounting rarely behaves this way.

During close and reconciliation, data is often inconsistent, formats change from month to month, documentation may be incomplete, and timing differences require judgment. When a workflow encounters a scenario it was not explicitly programmed to handle, it cannot adapt. The process stops and requires human intervention to decide the next step.

No matter how many steps or tools are added, this structure remains an AI workflow. The AI can assist with execution, but the human remains responsible for evaluating results, deciding what to do next, and directing the process forward.

As long as the human is the decision maker, the system is operating as a workflow not an AI agent.

What Are AI Agents?

AI agents are designed to own decision-making within defined guardrails.

Unlike workflows, which require a human to decide what happens next, an AI agent is responsible for interpreting the goal, determining the appropriate steps, and taking action on its own. The human defines the role, rules, and boundaries, but the agent executes the work end to end.

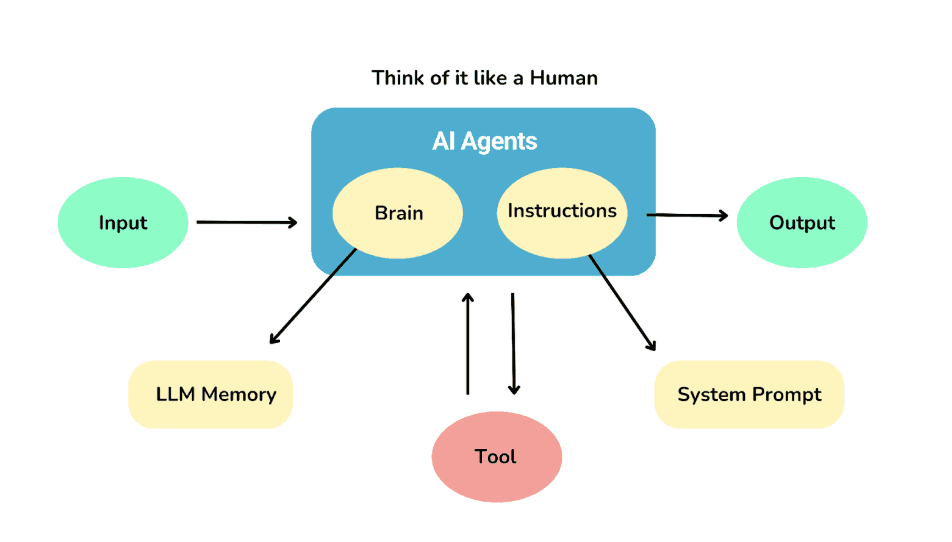

In an AI agent system, an input is still provided by a user, such as a request to reconcile data or prepare a workpaper. However, instead of waiting for human direction at each step, the agent uses its internal logic to decide how to proceed.

The agent evaluates the input, references prior context and memory, selects the appropriate tools, and takes action. After acting, it checks whether the result makes sense and iterates if necessary. Only when the work is ready for review or when an issue requires escalation does the agent involve a human.

Decision-making moves inside the system.

Why Iteration Is the Defining Difference

Humans are still acting as the agent. An accountant reviews source data, identifies discrepancies, adjusts assumptions, reruns calculations, refines the workpaper, and repeats the process until everything ties out. That iterative loop is core to accounting work and is required because close data is rarely perfect the first time through.

AI agents are designed to replicate this same pattern by introducing feedback loops into the system. Instead of producing a single output and stopping, an agent evaluates its own work, revises its approach, re-applies tools, and iterates until the result meets defined criteria.

For agents to do this effectively, they must be grounded in context. That is why historical data, prior workpapers, and past decisions matter. Within Truewind, AI learns expected formats, common exceptions, and acceptable outcomes. This allows them to improve over time while still operating within defined accounting controls. Iteration is what transforms automation from one-time execution into review-ready preparation.

Addressing Challenges and Misconceptions

One of the most common concerns around AI agents is whether they are replacing accountants. They are not.

The reality is that accounting teams are facing a growing talent gap alongside increasing workload and complexity. As experienced professionals retire and close timelines continue to tighten, AI agents are increasingly being used to absorb repetitive preparation work so accountants do not burn out early in their careers. Automation helps shift time away from manual, low-value tasks and toward higher-impact work such as review, analysis, and decision-making.

In this model, accountants are not removed from the process. Their role evolves. Instead of spending time assembling workpapers or reconciling data by hand, they act as reviewers and approvers to provide judgment and accountability where it matters most.

Another common concern is data privacy and trust. This concern is valid as not all AI systems are built with the same standards for transparency, auditability, and control. Truewind has proudly achieved SOC 2 Certificable, ensuring our AI is built with security, transparency, and auditability.

Take the first step toward a faster close and explore how Truewind’s Workpaper Agent handles manual preparation work.